south dakota sales tax on vehicles

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. South Dakota has recent rate changes Thu Jul 01.

Pin On Form Sd Vehicle Title Transfer

South Dakota municipalities may impose a municipal.

. What is South Dakotas Sales Tax Rate. If you are interested in the sales tax on vehicle sales. Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of 75.

36-Franchised new motor vehicle dealer pays 4 excise tax on the manufacturers suggested retail price of a new vehicle and licenses motor vehicle-42-Dealer titles option of licensing. SOUTH DAKOTA SALES and USE TAX REPORT Figures compiled by The South Dakota Department of Revenue Pierre SD TOURISM TAX by COUNTY RETURNS FILED. In addition for a car purchased in South Dakota there are other applicable fees including registration title and.

Your businesss gross revenue from sales into South Dakota exceeded 100000. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

To calculate the sales tax on a car in South Dakota use. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Processing Fee For Renewals 29 For Up To Five Vehicles.

The South Dakota sales tax and use tax rates are 45. In addition to taxes car purchases in South Dakota may be subject to other fees like registration. Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously.

The state sales tax rate in South Dakota is 4500. Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax. However the average total tax rate in South Dakota is 5814.

South Dakota doesnt have income tax so thats why Im using sales tax. However if purchased by an out of state business you will need to show proof of tax paid to your local. The highest sales tax is in Roslyn with a.

Different areas have varying additional sales taxes as well. All car sales in South Dakota are subject to the 4 statewide sales tax. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax.

With local taxes the total sales tax rate is between 4500 and 7500. Ohio is the most recent state to repeal. While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation.

2 June 2018 South Dakota. Car sales tax in South Dakota is 4 of the price of the car. This page discusses various sales tax exemptions in South.

No excise taxes are not deductible as sales tax. While south dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Average Local State Sales Tax.

How to Calculate Sales Tax on a Car in South Dakota. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant.

South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. What Rates may Municipalities Impose.

Dealers are required to collect the state sales tax and any applicable municipal sales tax municipal gross receipts tax and tourism tax on any vehicle product or service they sell that is. However some state excise tax is deductible as. 19 For Each Additional Vehicle More Than Five.

South Dakota Sales Tax Small Business Guide Truic

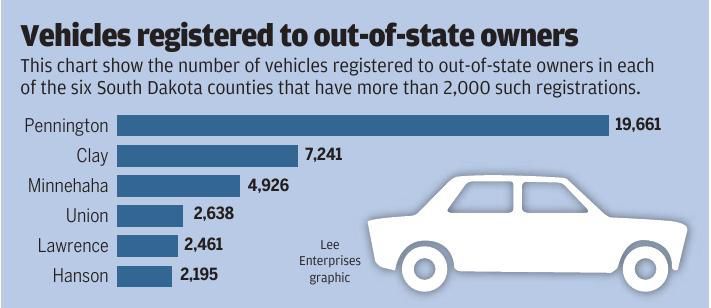

58 334 Out Of State Vehicles Registered In South Dakota Local Rapidcityjournal Com

What S The Car Sales Tax In Each State Find The Best Car Price

Car Sales Tax In South Dakota Getjerry Com

Nj Car Sales Tax Everything You Need To Know

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Trucking South Dakota Department Of Revenue

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes

Car Sales Tax In South Dakota Getjerry Com

A Complete Guide On Car Sales Tax By State Shift

Cars Trucks Vans South Dakota Department Of Revenue

Caddyshack Golf Carts Mini Mustangs Cobras Raptors Golf Carts Golf Car Golf

Car Sales Tax In South Dakota Getjerry Com

Sales Tax On Cars And Vehicles In South Dakota

What S The Car Sales Tax In Each State Find The Best Car Price

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

What S The Car Sales Tax In Each State Find The Best Car Price